The financial habits of Bangladesh

have shifted dramatically in just a few years. According to Bangladesh Bank’s

latest data, over 239 million mobile

financial service accounts are active, with monthly transactions

exceeding Tk 1.72 trillion. That

means nearly every family, retailer, and service provider around you now relies

on mobile money at some point each month.

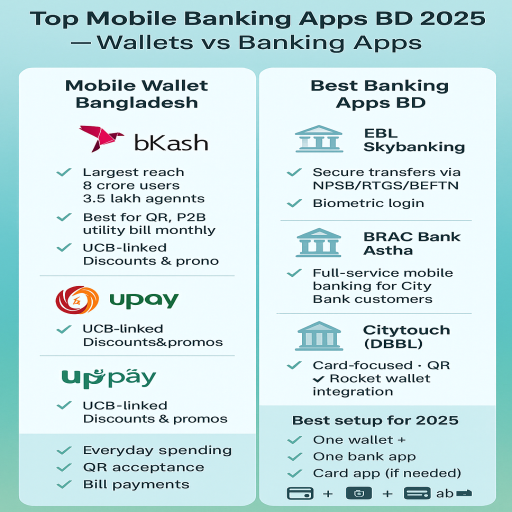

This growth is not evenly spread. bKash controls the lion’s share with 8

crore users and 3.5 lakh agents. Nagad,

however, is catching up fast, crossing BDT

340 billion in transactions in March 2025. When you decide on the best mobile banking apps BD, you are

deciding which system will protect your time, your money, and your peace of

mind.

If you simply download based on

advertisements, you risk disappointment. To guide you better, I compared apps

using five criteria:

This framework lets you compare the best mobile banking apps BD on facts

instead of hype.

|

Feature |

bKash |

Nagad |

upay |

|

User base |

~8 crore |

Growing fast, record BDT 340B monthly |

Moderate, linked with UCB |

|

Agent network |

3.5 lakh+ |

Expanding steadily |

Smaller |

|

Best use case |

Everyday QR payments, P2P transfers |

Backup wallet, utility bills, government fees |

Promotions, UCB-linked services |

|

Strength |

Widest acceptance |

Low cost and speed |

Frequent discounts |

|

Weakness |

Higher fees than competitors |

Still catching up in reach |

Limited outside UCB ecosystem |

👉

If you shop daily at corner stores, bKash keeps you safe. If you need a backup

to handle network congestion, Nagad gives you breathing room. If you value

deals and already bank with UCB, upay fits naturally into your life.

|

Feature |

BRAC Bank Astha |

Citytouch (City Bank) |

EBL Skybanking |

DBBL NexusPay |

|

Transfer systems |

NPSB, BEFTN, RTGS |

Fund transfers, DPS, FD |

NPSB, RTGS, BEFTN |

Card + Rocket wallet |

|

Security |

OTP on each transaction |

Two-factor login |

Biometric + OTP |

Card tokenization |

|

Interface |

Clean, focused on transfers |

Full-service, rich features |

Modern, user-friendly |

Card-centric |

|

Best for |

Frequent interbank users |

City Bank account holders |

Utility payments & secure

transfers |

DBBL card users |

|

Weakness |

Limited features beyond transfers |

Works best only for City customers |

Requires familiarity with banking

terms |

Feels heavier than wallets |

👉

If your main need is sending money across banks, BRAC Astha and EBL Skybanking

give you strong reliability. If you bank with City Bank, Citytouch saves you

branch visits. For card lovers, NexusPay is the most practical.

Most professionals I know use one

wallet and one bank app. This combination ensures you don’t get stuck when one

system slows down.

Here’s where you need to be alert:

If you don’t track limits, you may

face blocked transfers at critical hours, like when paying Tk 30,000 after 11

p.m.

If you want a balanced approach,

here’s what I recommend:

This trio covers both convenience

and financial depth. It ensures you never depend on one channel and gives you

flexibility at all times.

The question isn’t whether you

should use mobile banking. You already do. The real question is: are you using

the best mobile banking apps BD

for your lifestyle? If you shop daily, pay bills, and transfer funds regularly,

the apps you pick decide how smooth or stressful your financial routine

becomes.

By choosing wisely between mobile wallet Bangladesh leaders like

bKash and Nagad, and the best banking

apps BD such as Skybanking or Astha, you’ll turn your phone into a

reliable financial toolkit that saves you time, money, and unnecessary

headaches.

FAQs for Top Mobile Banking Apps in Bangladesh 2025

Q1. Which is the best mobile banking

app in Bangladesh 2025?

You’ll find bKash leading for

everyday use, Nagad for backup, and EBL Skybanking or BRAC Astha for smooth

interbank transfers.

Q2. What is the most used mobile

wallet Bangladesh right now?

bKash holds the largest share with

around 8 crore users and unmatched merchant acceptance, making it the most used

mobile wallet Bangladesh.

Q3. Which apps are safe for

interbank transfers in Bangladesh?

BRAC Bank Astha and EBL Skybanking

stand out for NPSB, BEFTN, and RTGS transfers with OTP and biometric security.

Q4. Are mobile banking apps BD free

to use?

You can download and register for

free, but transaction charges and cash-out fees apply. Each app has different

rates, so you should always check inside the app.

Q5. Should I use more than one

mobile banking app BD?

Yes, keeping both a wallet (bKash or

Nagad) and a bank app (like Citytouch or Skybanking) gives you flexibility if

one system slows down or fails.

Comments (0)

Leave a Comment

No comments yet

Be the first to share your thoughts!